How To Manage Business Risk

- Businessgrowthlaw

- Jan 21, 2021

- 3 min read

Updated: Feb 9, 2021

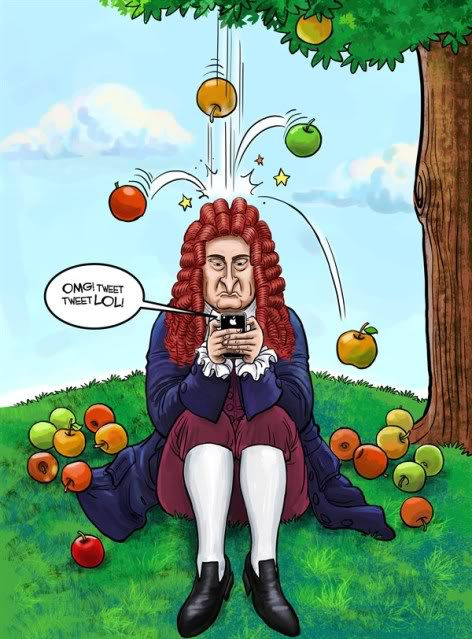

Risk management isn’t just about avoiding disaster. A successful risk management strategy should also have plenty of upside. Those who are old enough to remember the Apple Newton will appreciate this.

In 1993 Apple gambled on launching this expensive, revolutionary Personal Digital Assistant. Newton’s size and inefficient handwriting recognition interface eventually led to market failure for the product, but was not the end for Apple.

Apple’s underlying business model was robust enough to withstand this setback, absorb the lessons learned, and move on.

In New Zealand, business owners who take a disciplined strategic approach to risk management must still be in the minority, in light of our high failure rate for businesses of all types. So here are some strategies to help protect your business’s future.

Review

(a) General business risks

One or more of the following risks will impact most businesses:

Product/Services issues

Damage to customers/their property

Professional negligence

Breach of laws and regulations

Cash flow problems/Tax issues

Breach of contract-by business or its partners

Loss of goodwill

Customer payment default/business failure

Natural disasters

Shareholder disagreements

Intellectual property theft

(b) Industry risks

Understand how business models in your industry are evolving in New Zealand, Australia, US, UK, Europe, Asia and other comparable markets.

For example, consider the Airbnb sharing model, conceived in San Francisco in 2007, active in 89 countries by 2011, arrived in New Zealand in 2016, and now seriously disrupting our accommodation market.

(c) Future trends

Evaluate whether:

New technology could undermine your business model

Your business could be regulated out of existence

The Watson mainframe computer first came into public view in 2011, winning the quiz show Jeopardy. Its technology is now incorporated into over 17 major industries, including the legal profession. A large US law firm has built and “employs” a robotic lawyer called Ross, and hopes to export “him” to work in law firms around the world.

The technology may not be highly sophisticated. Take Uber, the ubiquitous taxi service which is not really very different, but vitally, has branding and features which appeal to younger tech-savvy consumers. Airbnb is in the same category.

Also consider what would happen to our dairy farming if intense competition from new model food industries for water and land develops, and producing milk becomes very costly?

2. Mitigate

(a) Insurable risks

Standard types of business cover in NZ include:

Public, employer’s, statutory & cyber liability

Professional indemnity

Trade credit

Property loss/damage

Key person

Business interruption

The main problems with relying on insurance cover to mitigate risk are:

Foreseeability– has the particular risk been properly identified to your insurer ?

Disclosure– do you disclose all relevant information?

Insurer stability– credit rating, payout history etc?

Cost– comprehensive cover may be prohibitively expensive

(b) Other Risks

Despite its drawbacks, insurance still remains the primary method of dealing with most general business risks. But what about those risks which are hard to insure against, or unexpected, such as human behaviour, future trends, regulation or industry disruption?

3. Plan

The best way to manage and minimise all business risk is analysis and strategic planning.

Larger businesses address complex strategic risk issues, plan well ahead as a matter of course, and are generally in better financial shape to survive business disasters. Accordingly, the benefits of a disciplined approach to managing business risk will be much greater for smaller businesses, which usually do not get a second chance.

4. Question

Constantly question what is going on around your business. Here’s one for you.

Which category of risk does our Apple Newton example above fit into?

5. Prioritise

Identify and prioritise risk areas on the horizon for your business.

Comments